David Talley, CFP®, ChFC®, EA is an entrepreneur-turned-advisor with over 15 years of experience helping clients make smart financial decisions. As founder of Talley Financial, he blends tax expertise with real-life insight to guide families, entrepreneurs, and advisors. When he’s not working, he’s spending time with his wife and kids or exploring the Appalachian Highlands.

What Tax Planning Really Looks Like - What Most People Get Wrong

Table of Contents

- What Most People Get Wrong About Tax Planning

- Step 1: Safe Harbor Planning

- Step 2: Projecting Your Actual Tax Liability

- Who Benefits Most From Tax Planning

- Step 3: Choosing the Right Strategies for the Year

- Why It All Matters

- What To Do Next

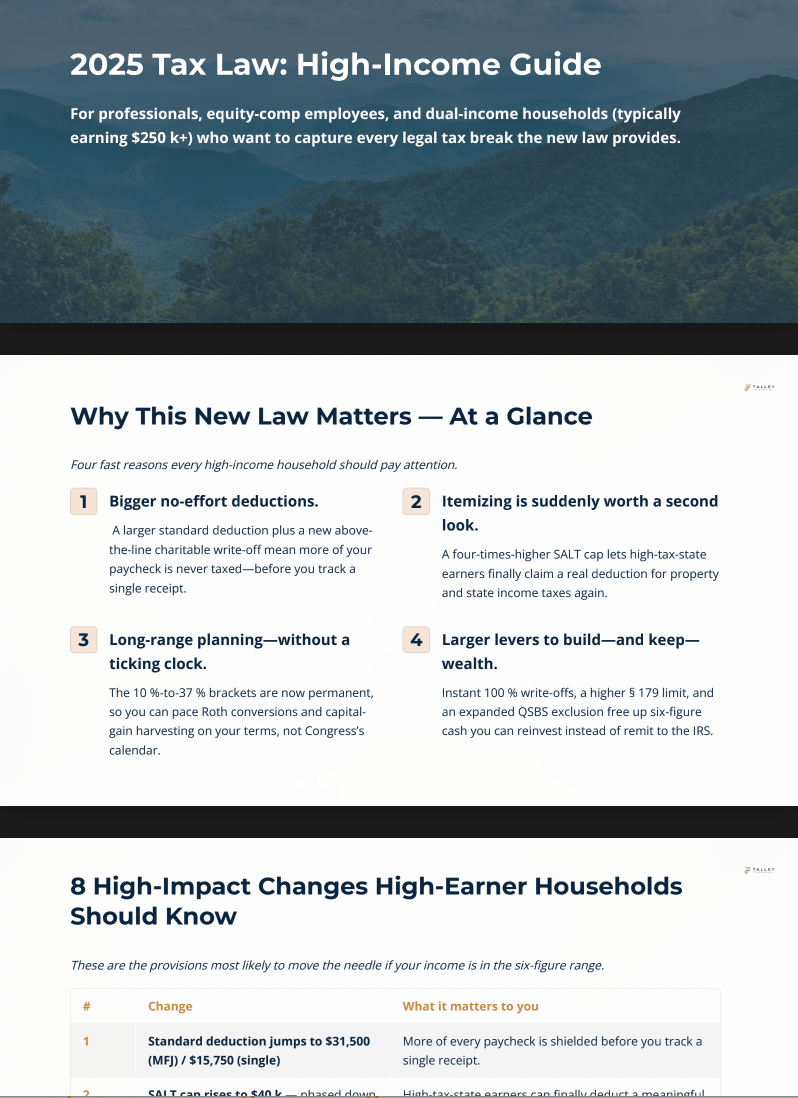

What Most People Get Wrong About Tax Planning

Most people think of tax planning as something their CPA does right before April 15th. Maybe they find a last-minute deduction or double-check your return to make sure there are no errors.

That’s not tax planning. That’s tax preparation. And while it’s important, it only looks backward.

Tax planning, on the other hand, looks forward. It helps you reduce your tax burden not just this year, but over the course of your lifetime. Done right, it aligns your income, investments, and business decisions with the tax code to put more money in your pocket.

In this article, I’ll walk you through what tax planning actually looks like, how we do it at our firm, who needs it most, and why it matters more than most people realize.

Step 1: Safe Harbor Planning

The first step in effective tax planning is making sure you avoid IRS underpayment penalties. That’s where safe harbor planning comes in.

For most high earners, the IRS requires you to pay in 100% to 110% of your previous year’s tax bill — or 90% of your current year’s projected tax bill — to avoid penalties.

We revisit this analysis twice a year:

- Spring: Based on your expected income and deductions

- Fall: With real numbers and year-to-date data

Safe harbor planning protects you from surprises and brings clarity to your cash flow.

IRS guidelines on estimated tax payments

Step 2: Projecting Your Actual Tax Liability

If you don’t know what your tax bill is likely to be, it’s difficult to plan effectively.

Projecting your liability helps you:

- Decide how much to contribute to retirement accounts

- Time charitable giving or large business purchases

- Set aside the right amount for estimated payments

- Evaluate whether to accelerate or delay income

IRS federal tax bracket thresholds

Who Benefits Most From Tax Planning

We typically see the biggest impact for:

- Entrepreneurs with growing or volatile income

- High-income professionals with bonuses, stock options, or equity comp

- Business owners preparing for or going through a sale

- Executives facing a buyout or liquidity event

- Pre-retirees managing future Required Minimum Distributions (RMDs)

- Real estate investors selling property or leveraging depreciation

Step 3: Choosing the Right Strategies for the Year

Strategies to Lower Income This Year:

- PTET elections, Solo 401(k), SEP IRA

- Maximize deductions (vehicle, home office, equipment)

- Entity structure changes, cost segregation studies

- Donor-Advised Fund (DAF) contributions

- QBI Deduction optimization

Strategies to Intentionally Increase Income:

- Roth 401(k) contributions

- Mega backdoor Roth conversions

- Tax gain harvesting in low-income years

Why It All Matters

Real tax planning is proactive, personalized, and integrated — done before year-end and tied to your long-term goals.

Year-End Tax Strategies

Smart Tax Planning for Early Retirement

PTET Breakdown

What To Do Next

If you’re wondering whether tax planning is right for you, that’s why we offer a Strategy Session. You’ll walk away with clarity — whether or not we work together long-term.