David Talley, CFP®, ChFC®, EA is an entrepreneur-turned-advisor with over 15 years of experience helping clients make smart financial decisions. As founder of Talley Financial, he blends tax expertise with real-life insight to guide families, entrepreneurs, and advisors. When he’s not working, he’s spending time with his wife and kids or exploring the Appalachian Highlands.

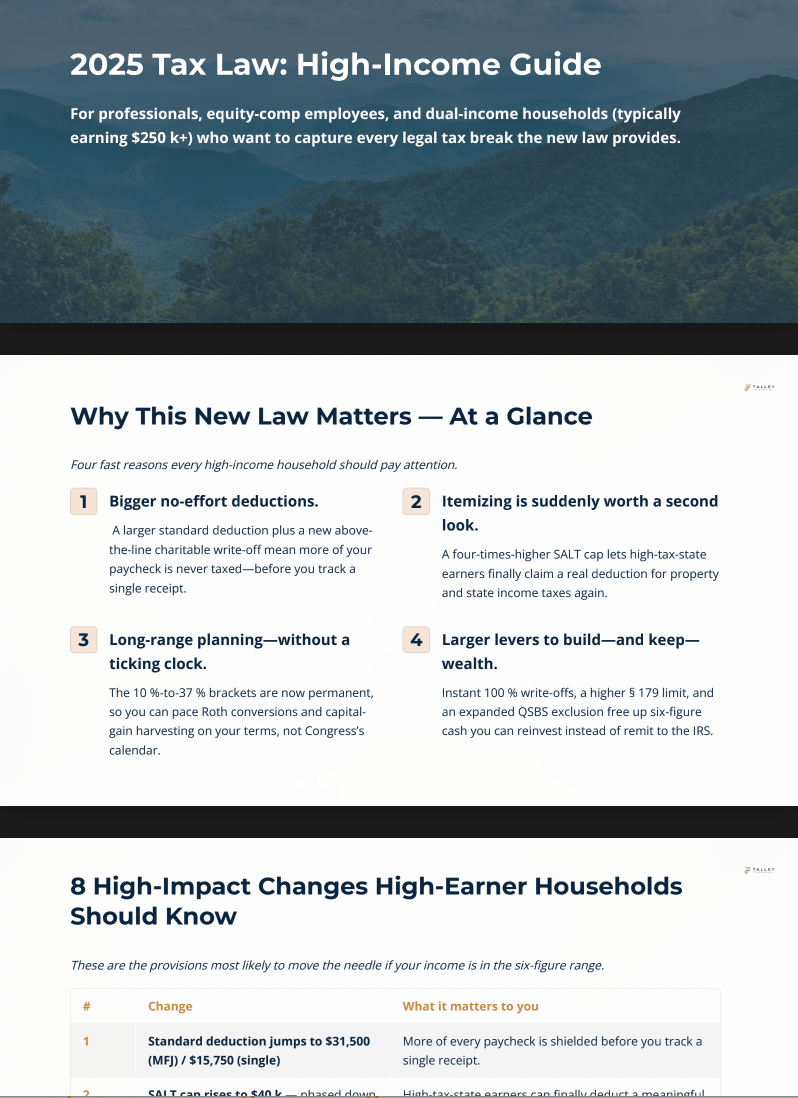

Estate Planning Essentials - The Three Steps That Actually Finish The Job

Table of Contents

- Introduction: Why a Will Isn’t Enough

- Step 1: Write It in Plain English

- Step 2: Draft the Right Documents

- Step 3: Align Your Assets

- Bonus: When a Trust Is Actually Worth It

- Bonus: Two Tax Moves to Preserve More for Heirs

- Wrap-Up: Your Action Plan

Introduction: Why a Will Isn’t Enough

“A will by itself is not a plan—it’s a single document looking for two more steps.”

Every week I meet families who assume they’re “all set” because they signed a will back when their kids were in diapers. Fast-forward ten years: new house, new job, maybe a grandchild on the way—yet their beneficiary forms still point to an ex-spouse and the house deed never made it into the revocable living trust they paid for.

In this post, I’ll show you the three-step finish-line framework that prevents those train wrecks, plus two bonus tax moves that can add six figures to what your heirs keep.

Step 1: Write It in Plain English

Estate planning starts with clarity, not legalese. Before you ever talk to a lawyer or open LegalZoom, sit down and answer four questions:

- Who should inherit your assets—and in what shares?

- Who should raise your minor children if you can’t?

- Who should make medical and financial decisions if you’re incapacitated?

- Are there any strings on inheritance—age, milestones, protections?

Action step → Download my Estate-Plan Checklist and use page 1 as your brainstorming sheet.

Step 2: Draft the Right Documents

Once your wishes are clear, convert them into legally binding documents. For most families, that includes:

- Will – Names guardians, heirs, executor

- Durable Power of Attorney – Lets someone handle finances if you can’t

- Healthcare Directive & HIPAA Release – Covers medical decisions and access

- Beneficiary / TOD / POD Forms – Override your will for most accounts

- Revocable Living Trust(optional) – Avoids probate and can stagger payouts

Note: A will alone doesn’t control retirement accounts or life insurance—those follow your beneficiary forms.

Step 3: Align Your Assets

This step is the most often skipped—and the most important.

Even the best documents won’t work if your accounts and property are titled incorrectly. Use this alignment checklist:

- Real estate → Titled to your trust via quit-claim deed

- Brokerage & bank accounts → Retitled or add TOD

- Retirement accounts → Update beneficiary forms

- Life insurance → Same as above

- Digital assets → Store credentials securely

Pro tip: Keep a one-page spreadsheet listing every account, titled owner, and beneficiary.

Bonus: When a Trust Is Actually Worth It

A revocable living trust is often smart if you:

- Have minor children

- Own property in multiple states

- Want to keep your estate private

- Have a special-needs heir

- Have a net worth ≳ $1 million (including life insurance)

A trust acts like a bucket: you pour assets in now so your trustee can pour them out later under your rules. But a trust without assets is just an empty bucket.

Bonus: Two Tax Moves to Preserve More for Heirs

- Step-up in basis: When you pass assets to heirs at death, capital gains are reset.

- Strategic Roth conversions: Convert IRA money during low-bracket years to create tax-free growth for your heirs.

Both of these moves pair well with a revocable trust, but don’t require one to be effective.

Wrap-Up: Your Action Plan

Here’s your 30-day estate plan sprint:

- Tonight: Jot your wishes in plain English

- Next 2 weeks: Draft or refresh your documents

- Week 4: Retitle every account & update beneficiaries

Still feeling stuck? Download the free checklist below—it breaks everything down by task.

Grab the Checklist—Finish Your Plan

Ready to move from “I should” to “It’s done”?

Download the Estate-Plan Checklist and spend 15 minutes tonight on Step 1.

Need a guide for Steps 2 & 3?

Schedule a 15-minute strategy call and let’s get it finished—without the probate drama.