David Talley, CFP®, ChFC®, EA is an entrepreneur-turned-advisor with over 15 years of experience helping clients make smart financial decisions. As founder of Talley Financial, he blends tax expertise with real-life insight to guide families, entrepreneurs, and advisors. When he’s not working, he’s spending time with his wife and kids or exploring the Appalachian Highlands.

Turn High Income Into Enduring Wealth: 2025 Tax Strategies for Johnson City Professionals

By David Talley, CFP® | Reading time: 7 minutes

Table of Contents

- Introduction

- Why This New Law Matters

- 8 High-Impact Changes

- Success Story

- FAQs

- Your Next 90 Days

- Tailored Tax & Financial Planning

Introduction

You're a high-income professional, an equity-comp employee, or part of a successful dual-income household here in Johnson City, TN. You work incredibly hard, contributing significantly to your field and community. And yet, year after year, it often feels like a substantial chunk of your hard-earned paycheck simply vanishes to taxes. It's a common frustration, and one we understand deeply.

The truth is, many high earners don't fully understand how their tax number is actually arrived at. It often feels like a mysterious, unavoidable deduction. But by shedding light on this process, our goal is to demystify it for you, giving you a sense of control and clarity over your financial future. It's not just about what you pay, but why and how you can optimize it.

While lowering your current year's tax bill is undeniably important, and we should absolutely pursue every legal avenue to do so, it's crucial to remember that the more meaningful decisions for building enduring wealth are often your investment decisions. This is because the growth on the assets you own ultimately makes a much larger difference long-term than simply paying a few extra thousand in taxes. Many tax advisors, in their focus on immediate savings, sometimes overlook this vital long-term perspective. Our approach is different: we help you integrate your tax strategy with your broader wealth-building goals.

Adding a fresh layer of opportunity to your planning is the "Big Beautiful Bill" tax law, enacted in July 2025. This new legislation brings significant changes with direct implications for high-income households, providing new avenues to capture every legal tax break and keep more of your wealth working for you.

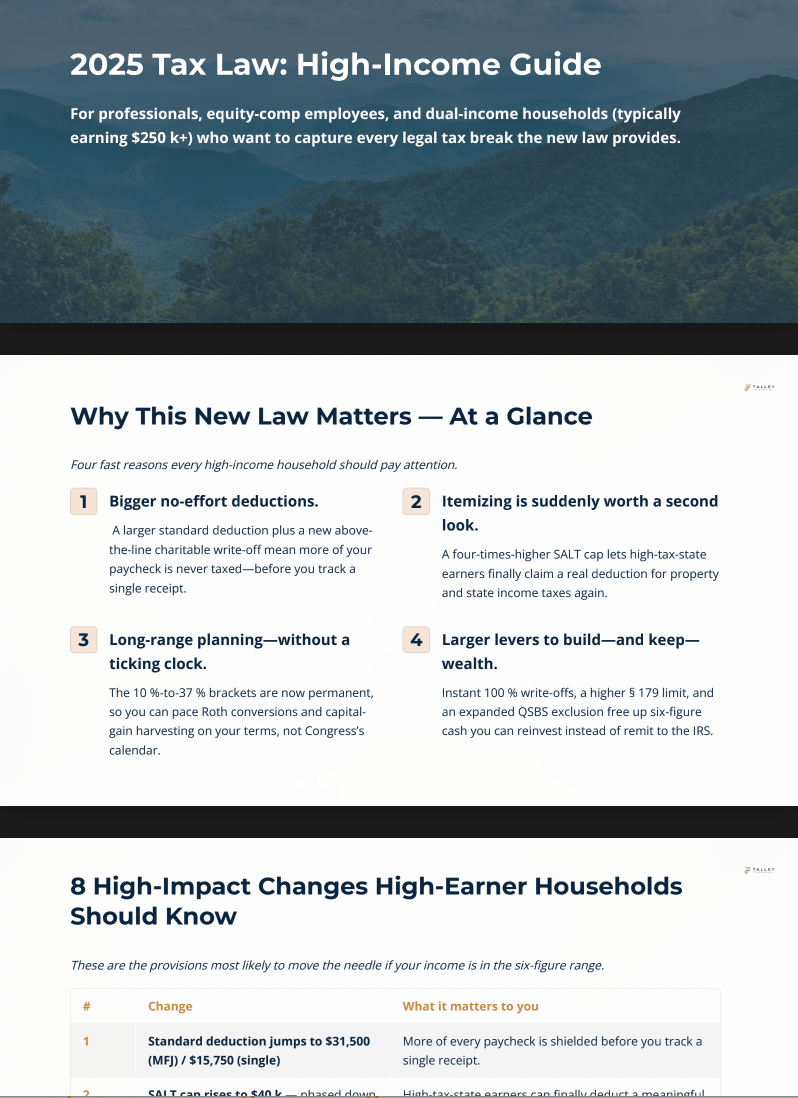

Why This New Law Matters – At a Glance

This new tax law, while containing its complexities, presents specific, high-impact opportunities for high earners like you. These aren't just minor adjustments; they're shifts that can directly influence how much of your income you keep and how quickly your wealth can grow.

- Bigger no-effort deductions. The standard deduction is getting a significant bump, leaping to $31,500 for a couple. This, combined with a new above-the-line charitable write-off, means more of your paycheck is never taxed—before you even track a single receipt.

- Itemizing is suddenly worth a second look. The SALT cap is increasing fourfold, allowing many to finally claim a real deduction for property and state income taxes again.

- Long-range planning—without a ticking clock. The 10% to 37% tax brackets are now permanent, providing flexibility for Roth conversions and capital-gain harvesting.

- Larger levers to build—and keep—wealth. Provisions like 100% write-offs, higher Section 179 limits, and expanded QSBS exclusions free up significant cash for reinvestment.

8 High-Impact Changes High-Earner Households Should Know

- Standard deduction jumps to $31,500 (MFJ)/$15,750 (single).

More of every paycheck is shielded before you track a single receipt. - SALT cap rises to $40,000, phased down once AGI tops $500,000.

High-tax-state earners can deduct a meaningful slice of property and state income taxes again. - 10%-37% brackets are now permanent.

You can pace Roth conversions and capital-gain harvesting without racing a 2026 "sunset." - Above-the-line charitable deduction: $2,000 joint / $1,000 single.

Even non-itemizers now get a direct write-off for cash gifts. - Child-tax credit increases to $2,200 per child (indexed).

Parents receive a larger dollar-for-dollar tax offset. - Car-loan interest deduction up to $10,000.

High earners financing vehicles can deduct interest whether or not they itemize. - 100% bonus depreciation + § 179 limit rises to $2.5 million.

Business owners and landlords can expense major purchases in year one. - HSA eligibility extended to ACA Bronze & Catastrophic plans (2026).

Millions gain access to tax-advantaged HSA savings.

Success Story: Turning an RSU Windfall + New Car Into Real-Time Tax Wins

Meet Sam and Jordan, both 39, a Staff Engineer and Sales Director, respectively.

Their 2025 Snapshot:

- Joint W-2 salaries: $300,000

- RSU vest: $60,000

- New SUV: $90,000 (financed, $6,000 first-year interest)

- Kitchen remodel on rental property: $45,000

Here’s how they leveraged the new tax law:

- Maxed every pre-tax bucket: $49,000 to 401(k), HSA, FSA — lowering AGI.

- Leveraged the $40,000 SALT cap — itemizing beat the standard deduction by ~$8,000.

- Claimed phased car-loan-interest write-off — deducted $2,000 interest.

- Took 100% bonus depreciation — expensed $45,000 remodel in year one.

- Used $2,000 above-line charitable deduction.

Net result: Their federal tax bill fell by ~$24,000 versus a do-nothing approach.

Illustrative only. Actual savings will vary. Not individualized tax, legal, or investment advice. Consult your advisor before acting.

Frequently Asked Questions

- How does the new $40k SALT cap phase out?

Full $40k deduction until $500k AGI (MFJ). Above that, it phases out until $600k AGI. - I don’t itemize—can I still deduct charitable gifts?

Yes, up to $2k joint / $1k single starting in 2026. - How does the new car-loan interest deduction work?

Applies to vehicles purchased 2025–2028, with phase-outs for higher AGIs. - What changed for QSBS gains?

Exclusion cap rises to $15m with tiered breaks: 50% at 3 years, 75% at 4, 100% at 5. - Our family uses an ACA Bronze plan—can we open an HSA?

Yes, starting in 2026. - Does bonus depreciation offset W-2 income?

Not directly — applies to business/rental property income. - Did the NIIT threshold change?

No, remains $250k MFJ / $200k single.

Your First Moves For The Next 90 Days

- Map your 2025-26 bracket & SALT picture.

- Max automatics: 401(k), HSA, Dep-Care FSA, and $2k charity deduction.

- If buying a 2025–28 vehicle, keep AGI below $250k to deduct car-loan interest.

- Plan asset buys for bonus depreciation & Section 179 benefits.

- True-up withholding/estimates so April’s bill matches new deductions.

The number on the screen only matters in relation to the life it provides for you. By actually caring about and understanding, and then connecting what you actually want to do in your lives, we can translate that into money decisions.

Ready for Tailored Tax & Financial Planning?

For busy high earners in Johnson City and beyond, navigating complex tax laws and making smart investment decisions can feel overwhelming. Our role is to provide you with the clarity and confidence to turn your high income into enduring wealth.

Learn how we help high-income professionals

Download the full 2025 Tax Law: High-Income Guide

Schedule a 15-minute strategy call

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Talley Financial are not affiliated. Cambridge does not offer tax or legal advice; Talley Tax Solutions does.