David Talley, CFP®, ChFC®, EA is an entrepreneur-turned-advisor with over 15 years of experience helping clients make smart financial decisions. As founder of Talley Financial, he blends tax expertise with real-life insight to guide families, entrepreneurs, and advisors. When he’s not working, he’s spending time with his wife and kids or exploring the Appalachian Highlands.

Business Owners: The 2025 Tax Law Changes That Mean More Cash for You

By David Talley, CFP® | Reading time: 9 minutes

Table of Contents

- 1. Why This New Law Matters

- 2. 8 Tax Changes Business Owners Should Put to Work

- 3. Success Story: Turning a Mid-Year Upgrade Into a Six-Figure Tax Win

- 4. Frequently Asked Questions

- 5. Your First Moves for the Next 90 Days

- 6. Ready for Tailored Tax & Financial Planning?

As a business owner with healthy six-figure profits, you understand what it takes to drive growth, innovate, and create value. You're an entrepreneur, and you instinctively know how to make your business thrive. But are you truly maximizing your cash flow and long-term wealth?

For most business owners, true wealth isn't primarily built by diversifying into various investments at the outset; it comes from focusing resources and reinvesting in the growth of their primary business. Once that wealth is real, and at a meaningful amount for you, then we can talk about diversifying. This might be a different perspective than what many financial planners offer, but it’s a core belief of ours.

However, a common challenge arises when the financial aspects of your business and your personal finances, especially taxes, aren't strategically linked. This often leads to missed opportunities – opportunities to keep more cash working inside your business.

Adding another layer of importance to your planning is the "Big Beautiful Bill" tax law, enacted in July 2025. This new legislation brings significant changes that S-corp and LLC owners need to understand. This isn't just about helping reduce next April's tax bill; it's about making actionable moves now that can keep more cash working inside the business for growth and profit.

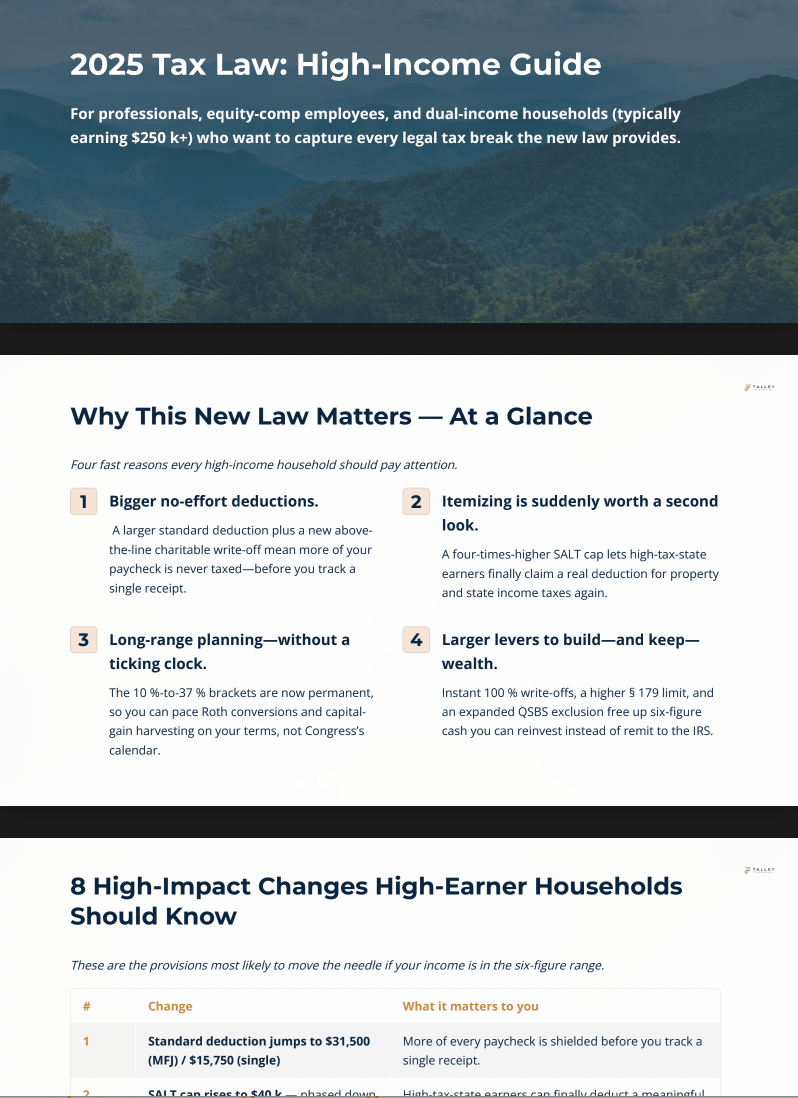

Why This New Law Matters

Here are four key reasons why this new tax law matters to you as a business owner:

- Bigger, faster write-offs. The return of 100% bonus depreciation and a higher §179 limit ($2.5 million) means you can expense equipment, vehicles, and tenant improvements in year one. This frees up cash to reinvest directly back into your business instead of waiting years for cost recovery.

- S-corp and LLC profits stay shielded. The 20% Qualified Business Income (QBI) deduction survives with a wider phase-out band. Plus, the PTET (Pass-Through Entity Tax) workaround is now permanent, helping cut both federal and state liability.

- More room to manage personal taxes. A larger standard deduction ($31,500 for a couple) plus a $40,000 SALT cap gives more flexibility to balance business growth with personal tax efficiency.

- Estate-planning pressure dialed back. With the exemption boosted to $15 million per person, most owners can focus first on succession and liquidity strategies without rushing into complex transfer structures.

8 Tax Changes Business Owners Should Put to Work

These provisions pack the biggest punch for S-corp and LLC owners reinvesting six-figure profits:

- 100% bonus depreciation reinstated. Expense the full cost of equipment, vehicles, or tenant improvements in year one.

- §179 cap doubles to $2.5 million. Immediate write-offs even if bonus depreciation doesn’t apply.

- PTET workaround permanent. Converts non-deductible state tax into a federal deduction.

- 20% QBI deduction survives. Wider phase-out band allows more profit to qualify.

- Standard deduction jumps.$31,500 (MFJ) plus $40k SALT cap.

- Above-the-line charitable deduction.$2k joint / $1k single even with the standard deduction.

- QSBS expansion.$15m cap with exclusions at 3/4/5 years.

- Estate & gift exemption increases.$15m per person.

Success Story: Turning a Mid-Year Upgrade Into a Six-Figure Tax Win

Case Study: Riverstone Design Co., an S-corp interior-construction firm

- Owner salary: $160,000

- Net business profit: $520,000

- New CNC & spray booth purchased: $275,000 (June 2025)

- State PTET rate: 6%

Steps taken and results included leveraging PTET, §179, QBI, charitable deduction, and updated estimates, leading to an approximate $132,000 lower tax compared to straight-line depreciation and no PTET.

This case study is illustrative and not a guarantee of future results. Consult a professional before acting.

Frequently Asked Questions

- Does bonus depreciation offset my W-2 salary? Yes—if you materially participate.

- How do PTET payments affect distributions? Most states allow dollar-for-dollar credits.

- Does the wider QBI phase-out band mean service businesses always get 20%? Not always; high-margin practices may still exceed thresholds.

- How do the $40k SALT cap and PTET interact? PTET reduces business income before Schedule A, and SALT applies on top.

- Does QSBS gain exclusion interact with S-corp income? No; it depends on the C-corp and holding period.

- Can I split §179 and bonus depreciation? Yes; both can apply strategically.

- Do I need to unwind old estate freezes? Probably not immediately; review annually.

Your First Moves for the Next 90 Days

- Re-check salary vs. profit split to preserve full QBI.

- Elect or renew PTET early to capture deductions.

- Lock in 100% write-offs for equipment/build-outs.

- Max out retirement and health savings contributions.

- Update Q3/Q4 estimates so cash flow matches new deductions.

Ready for Tailored Tax & Financial Planning?

We help business owners understand their tax strategies and plan with confidence.

Learn more about Business Owner Financial Planning

Download the 2025 Business-Owner Smart Action Guide

Schedule a 15-minute strategy call

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Adviser. Cambridge and Talley Financial are not affiliated. Cambridge does not offer tax or legal advice; Talley Tax Solutions does.