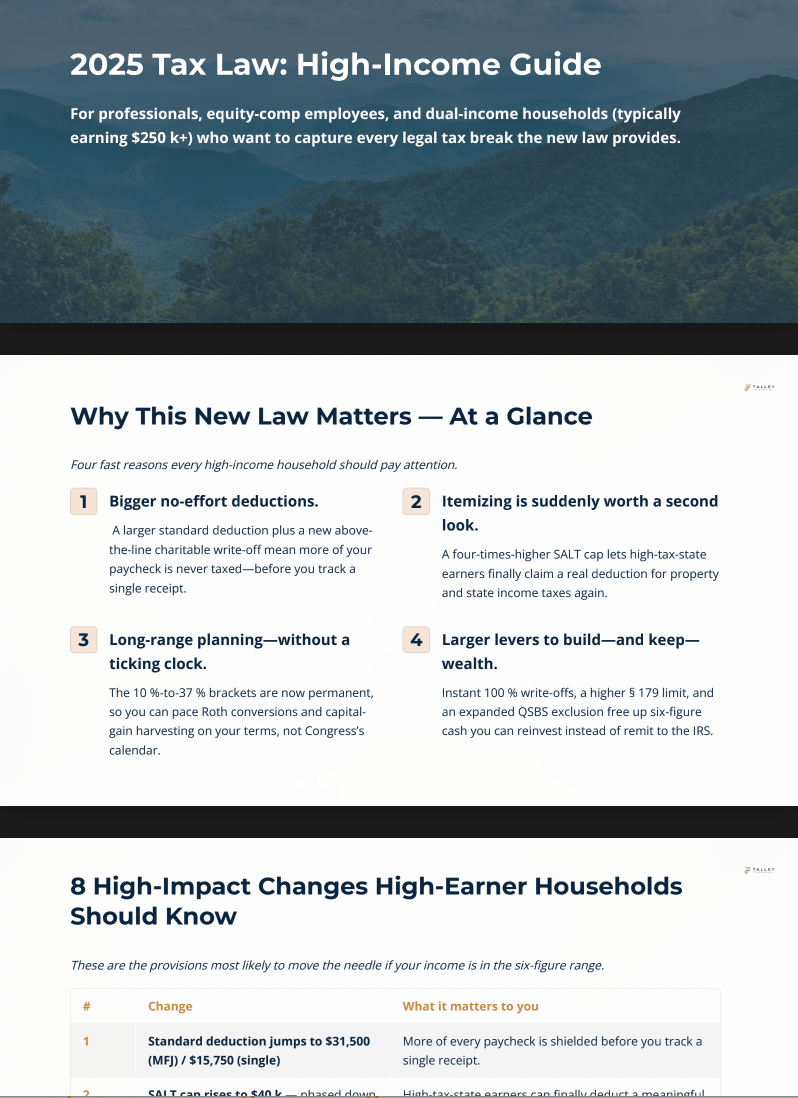

At Talley Financial, based in Johnson City, TN, we do more than manage money—we build lasting partnerships. Our process is designed to simplify financial complexity, align your wealth with your goals, and empower you to achieve financial clarity and confidence.

Talley Financial offers tailored Financial Services for every stage of life, helping families and businesses in Johnson City achieve lasting financial clarity with expert strategies tailored to every stage of life.

Explore our services:

https://www.mytalleyfinancial.com/pricing-and-services