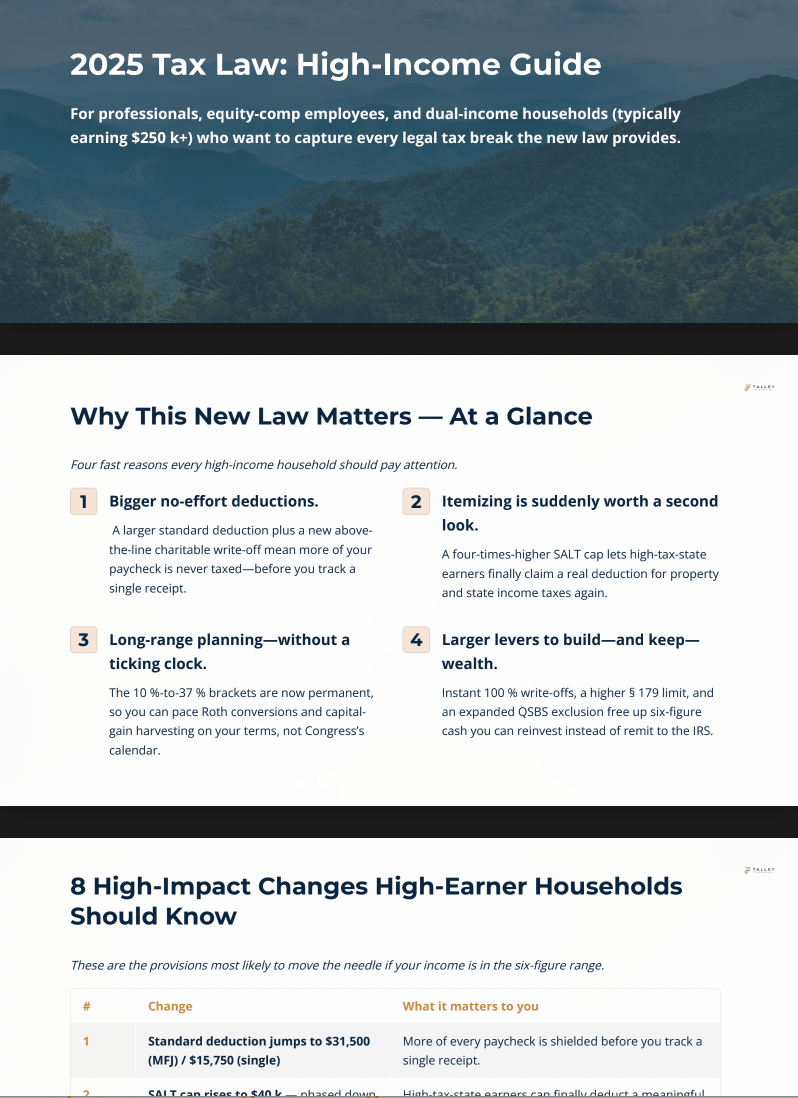

Rethinking Debt: Focus on Reduction Instead of Elimination

Rethinking Debt: Focus on Reduction Instead of Elimination

By David Talley CFP®

Debt management often means becoming debt-free. But, what if a potentially more effective strategy involves only significantly reducing your debt instead of eliminating it? This perspective can help you achieve financial stability while pursuing other crucial financial goals.

Understanding Debt Management

The traditional view of debt suggests that the ultimate goal should be to eliminate debt entirely. However, financial experts argue that maintaining manageable debt can be beneficial. According to a report by theFederal Reserve, approximately 77% of American households carry some form of debt, with manageable debt being integral to credit scores and overall financial health. For many individuals, the real goal should be to reduce debt to a level that supports their financial aspirations. As financial plannerDavid Bach emphasizes, “It’s not about being debt-free; it’s about being financially free.” This means adopting a mindset that sees debt not just as a burden but as a tool for financial growth when managed wisely.

Balancing Debt with Other Financial Goals

Instead of focusing solely on becoming debt-free, consider other financial objectives that contribute to your overall stability, including:

- Building an Emergency Fund: Having a savings cushion can protect you from unexpected expenses. A study byBankrate found that 21% of Americans have no emergency savings at all, highlighting the importance of prioritizing savings alongside debt reduction.

- Investing for Growth: While it may seem counterintuitive to invest while in debt, starting early can yield significant returns through the power of compounding. For example, if you invest just $100 a month in a diversified index fund with a 7% annual return, it could grow to over $40,000 in 30 years, even if you were to carry a small amount of debt during that time (Investopedia).

- Maintaining Good Credit: Carrying a small amount of debt can actually help maintain a healthy credit score, as long as payments are made on time. A good credit score can lead to lower interest rates on loans, which can be beneficial in the long run (Experian).

Practical Steps to Cutting Down Debt

- List Your Debts: Begin by documenting all your debts, including balances, interest rates, and minimum payments. This gives you a clear view of your financial obligations and aids in strategic decision-making.

- Create a Budget: Develop a budget to track income and expenses, identifying areas where you can reduce spending to allocate more toward debt repayment. According to the National Endowment for Financial Education, budgeting is one of the most effective tools for managing finances.

- Prioritize Payments: Choose a payment strategy that works for you:

- Avalanche Method: Focus on high-interest debts first to minimize the total interest paid.

- Snowball Method: Pay off the smallest debts first for quick wins that can motivate you to continue. Research shows that the Snowball Method can lead to higher rates of success due to the psychological boost of paying off smaller debts quickly (The Simple Dollar).

- Consider Consolidation: If juggling multiple payments is overwhelming, debt consolidation can simplify your financial life and potentially lower your interest rates. For example, consolidating credit card debt with a personal loan could save you money and reduce the number of payments you need to manage.

- Seek Financial Advice: Consulting a financial planner can provide personalized strategies tailored to your specific financial situation. A study by the Financial Planning Association found that individuals who work with financial advisors are more likely to achieve their financial goals.

A New View on Debt: Seeing It as a Tool

Recognizing that not all debt is detrimental can transform your approach to finances. Wealthy individuals often use "good debt" strategically to leverage investments and grow their wealth. For instance, real estate investors commonly use mortgages to finance properties, which can appreciate over time and generate rental income. This strategy allows them to build wealth while managing debt effectively.

Closing Thoughts: Planning

Adopting a flexible mindset and strategic approach to debt management helps align your financial actions with personal goals. Rather than just eliminating debt, think about integrating it into a broader financial strategy that includes saving, investing, and maintaining credit. By focusing on reducing debt while pursuing other financial objectives, you can take confident steps toward a stable and prosperous future. Remember, it’s about making informed decisions that contribute to your overall financial wellness rather than a one-size-fits-all solution.