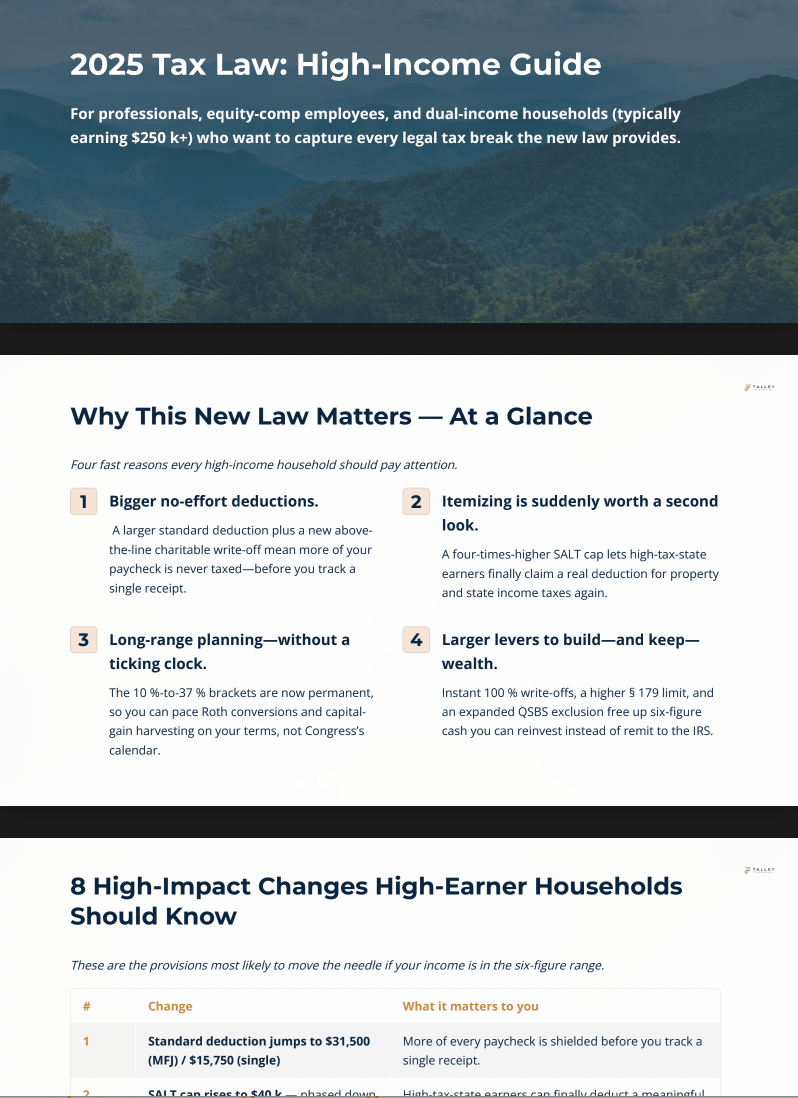

Talley Financial, located in Johnson City, TN, offers expert financial planning services tailored for retirees, small business owners, and high-income earners. Led by David Talley, CFP®, we specialize in tax strategies, retirement planning, and wealth management. Our personalized approach ensures every client experiences clarity, confidence, and peace of mind in their financial future. Serving clients in Johnson City, TN, Bristol, VA, and beyond. Visit us at https://www.mytalleyfinancial.com/pricing-and-services to learn more about our services.

Mastering Health Savings Accounts: Save on Taxes and Healthcare Costs

Mastering Health Savings Accounts: Save on Taxes and Healthcare Costs

By David Talley, CFP®

When planning for healthcare expenses, it's easy to focus solely on the costs. But what if your healthcare strategy could also double as a tax-saving powerhouse? That's where Health Savings Accounts (HSAs) come in.

HSAs offer a unique combination of tax benefits and flexibility that can help you manage medical costs today while building savings for the future. Let's dive into how HSAs work, their powerful triple-tax advantage, and how to determine if they're the right choice for your healthcare and financial planning needs.

What Is an HSA?

A Health Savings Account (HSA) is a personal savings account designed to help you pay for qualified medical expenses. But unlike a standard savings account, an HSA offers unmatched tax benefits. To open and contribute to an HSA, you must be enrolled in a High Deductible Health Plan (HDHP) that meets specific criteria set by the IRS.

HSA-Eligible Plans: What Qualifies?

For 2024, an HDHP must meet these requirements to qualify for HSA contributions:

- Minimum Deductible: $1,600 for individuals or $3,200 for families.

- Maximum Out-of-Pocket Limit: $8,050 for individuals or $16,100 for families.

Plans with co-pays for services before meeting the deductible or supplemental coverage (like an FSA or Medicare) typically disqualify you from contributing to an HSA.

How HSAs Work

Once you're enrolled in an eligible HDHP, you can open an HSA and begin contributing funds. These funds can be used to pay for qualified medical expenses , including:

- Doctor visits and hospital bills

- Prescription medications

- Dental and vision care

- Certain over-the-counter items

The real magic of an HSA lies in its triple-tax advantage.

The Triple-Tax Advantage of HSAs

- Tax-Deductible Contributions

Contributions to an HSA reduce your taxable income. For example, if you contribute the maximum $3,850 for an individual and are in the 24% tax bracket, you'll save $924 in taxes that year. - Tax-Free Growth

Funds in your HSA grow tax-free, whether through interest, dividends, or investment growth. Over time, this compounding can significantly boost your savings. - Tax-Free Withdrawals for Medical Expenses

When you use HSA funds for qualified medical expenses , those withdrawals are completely tax-free. This means you avoid income tax entirely on money saved, invested, and spent within the account for healthcare.

No other account type offers these three benefits simultaneously.

HDHP vs. Standard Plans: How to Choose

Selecting between an HSA-eligible HDHP and a standard health plan requires careful consideration of your healthcare needs and financial situation.

When an HDHP with HSA Eligibility Makes Sense:

- Low Anticipated Medical Costs: If you're generally healthy and don't expect significant medical expenses, the lower premiums of an HDHP can save you money.

- Ability to Pay Out-of-Pocket: If you can afford the higher deductible without financial strain, an HDHP allows you to take advantage of the HSA's tax benefits.

- Tax-Saving Priorities: Maxing out HSA contributions can provide significant tax savings, making it a great choice for high-income earners.

When a Standard Plan Might Be Better:

- Chronic Conditions or High Healthcare Needs: Frequent doctor visits, prescriptions, or surgeries may mean the higher premiums of a standard plan are worth the lower out-of-pocket costs.

- Family Coverage with Multiple Expenses: If your family often meets out-of-pocket maximums, the lower deductible of a standard plan may make financial sense.

Using and Investing Your HSA

HSAs are flexible and can adapt to your short-term and long-term needs:

Short-Term Use

For immediate medical expenses, keep funds in a cash account or money market fund for easy access.

Long-Term Growth

For those who can afford to pay medical costs out of pocket, the HSA becomes a stealth retirement account. Many HSAs allow you to invest in mutual funds, ETFs, or individual stocks , growing your balance tax-free for future healthcare or retirement needs.

Maximizing HSA Contributions

To make the most of an HSA, aim to:

- Max Out Contributions: The HSA contribution limits for 2024 are $4,150 for self-only coverage and $8,300 for family coverage. Those 55 and older can contribute an additional $1,000 as a catch-up contribution.

- Leverage Employer Contributions: Many employers offer contributions to your HSA—take full advantage of this free money.

- Delay Withdrawals: Pay medical expenses out of pocket when possible, letting your HSA balance grow tax-free for years.

Are HSAs Right for You?

HSAs are a powerful tool, but their effectiveness depends on your health, financial goals, and ability to manage a high deductible. Take the time to evaluate your plan options , anticipated medical costs, and long-term savings needs.

Conclusion

Health Savings Accounts combine tax advantages, flexibility, and long-term growth potential, making them one of the most versatile tools in your financial arsenal. Whether you're saving for current medical expenses or building a tax-free healthcare fund for retirement, an HSA can help you achieve your goals while keeping more of your hard-earned money.

To get started, explore your employer's health plan options , calculate your anticipated healthcare costs, and consult with a financial advisor to create a strategy tailored to your needs. By using an HSA wisely, you're not just saving for healthcare—you're investing in your financial future.